Birkin vs. Bitcoin vs. Bricks: Which Actually Wins?

A comparative analysis of luxury Hermès handbags, ‘digital gold’ & real estate

Dear friends (and fam, hi Mom!) 💌

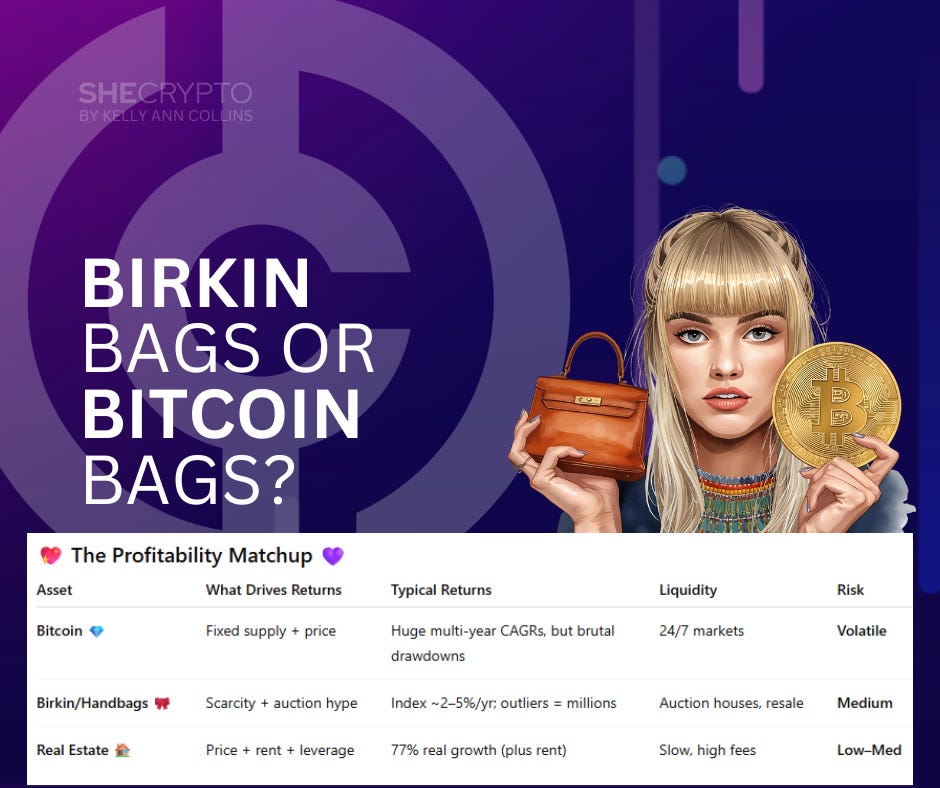

Today we’re diving into one of my favorite debates: what actually makes the better investment ~ luxury handbags, Bitcoin, or real estate?

On one side: Hermès Birkin bags, those coveted symbols of status that sometimes skyrocket at auction (hello, $10.1M Birkin sale 👀).

On another: Bitcoin, the internet’s new wild child.

And of course, the bricks-and-mortar standby: real estate.

In this piece, I break down how each has performed, what really drives their value, and which one comes out on top in the profitability showdown. As always, none of this is financial advice ~ just context and comparisons. Do your own research (DYOR) before making any moves!

OK, now - let’s grab some coffee (or champagne if you’re into that!) and get into it.

Cheers,

Kelly Ann ☕🍾

Bitcoin: Diamond Hands Required 💎✋

Over the past decade, Bitcoin has delivered some of the highest returns of any asset ~

annualized gains often in the tens of percent (e.g., ~82% over 10 years), with some single years exceeding 100%. But those eye-popping numbers come at a cost: Bitcoin is one of the most volatile assets in modern markets, with annualized volatility often above 50% and historical drawdowns of 70–80%.

Pro: unmatched historical upside.

Con: extreme volatility ~ staying invested requires conviction and resilience.

Luxury Handbags: Scarcity & Status 🎀

Hermès’ Birkin bags are often held up as the ultimate fashion “asset class.”

Over the long run, handbags have shown steady but not spectacular returns. AXA IM estimates a 10-year total gain of ~85.5% (just FYI - that’s cumulative across the decade, not per year).

Some earlier resale-market studies made bolder claims ~ suggesting Birkins outpaced gold and the S&P 500 with ~14% annual returns. But those figures came from reseller-funded research and are widely considered promotional. Independent benchmarks tell a different story: in 2024, handbags as a category rose just +2.8%, topping other luxury collectibles but far behind mainstream markets.

The catch? Outliers. In 2025, Jane Birkin’s original bag sold for $10.1M at Sotheby’s. Rare, celebrity-linked, or unique pieces can skyrocket ~ but the average Birkin doesn’t deliver that kind of performance, especially once you factor in fees, authentication costs, and resale friction.

Pro: cultural cachet, brand scarcity, and the chance of jackpot sales.

Con: illiquid, costly to trade, and dependent on rare outliers for big wins.

Real Estate: Bricks, Mortgages, Cash Flow

Residential real estate is the OG of wealth building. Since 1987, U.S. home prices are up about 410% nominal (~77% real). That’s not flashy compared to Bitcoin ~ or even Birkin headlines ~ but it’s steady. Add rental income and smart leverage, and suddenly the numbers look more appealing.

Near-term forecasts? Modest ~ about +2% growth in 2025, with mortgage rates still elevated. But long term, real estate delivers lower volatility, tax perks, and the ability to live in or rent out your investment.

Pro: stability, leverage, and passive income potential.

Con: low liquidity, high upfront costs, maintenance headaches.

SheCrypto Takeaways

Bitcoin is still the ultimate asymmetric bet. If you can stomach volatility, it’s been the most profitable.

Birkin bags can flex, but unless you snag a unicorn, expect modest returns. Treat it like art collecting, not a financial plan.

Real estate is the sleep-at-night option ~ especially if you’re playing the long game with rental income.

Best move? Mix your assets. Some BTC for moonshots, real estate for stability, and handbags if you love the culture and can play the provenance game.

Your keys. Your vibe. Your tribe.

📌 Some Notes on Bitcoin Collapses & Recovery

Bitcoin has a history of deep drawdowns following all-time highs:

Nov 2021 → Nov 2022: fell about 77.3% from peak.

Dec 2017 → Dec 2018: dropped roughly 84.1% after the 2017 bull run.

Nov 2013 → Jan 2015: collapsed by about 86.2%, one of the earliest major crashes.

Since the most recent low in Nov 2022, Bitcoin has staged a massive rebound:

Up ~606% from its Nov 30, 2022 level through today.

This rally followed the FTX collapse, which had marked the cycle bottom.

Even with big gains, volatility remains high ~ Bitcoin has had sharp monthly drops, and it often trades 20–30% below its all-time highs depending on timing.

These cycles are part of Bitcoin’s DNA: huge upside potential paired with repeated 70–80% declines.

Sources:

Sources & Further Reading

Handbags / Birkin

Bitcoin

Real Estate

💌 Join 6,000+ readers who get SheCrypto in their inbox each week ~ stories, insights, and unapologetic vibes!

Every read helps power 🚀 Unstoppable Future, my 501(c)(3) nonprofit for social impact + innovation that powers the Women In Blockchain initiative, which works at the community level to help women, girls and others learn about DeFi.

👩💻 About • ⚖️ Disclaimer / DYOR • 📣 Advertise